Behind each key phrase question is a consumer’s search intent; the cause an individual typed a string of phrases into the search bar. Check out this evaluation from Semrush, the digital advertising platform, to see how individuals’s relationship to the pandemic modified over time. Want much more website positioning tendencies and site visitors benchmarks? Download the full Semrush State of Search 2022 ebook right now.

The surge and decline of key phrases is sort of a temper ring for a way the world has felt about the pandemic. As vaccines rolled out, individuals searched much less for COVID testing and extra for inoculation. Search intent shifted from taking part in offense, in direction of protection.

As eating places closed and we remoted ourselves inside, demand for meals supply skyrocketed (surprisingly, not for Domino’s pizza!). As journey restrictions eased, individuals shifted away from restriction-mode to cocktail-on-the-beach mode.

Keyword tendencies reveal the interior workings of pandemic mindsets. Google grew to become the nameless helpline for COVID-related worries, hopes, and life planning.

The pandemic additionally launched a completely new vernacular—it modified the means we converse. With that, an array of search phrases was created. “PCR” and “rapid-test” had been on the ideas of our tongues and fingers as individuals searched for methods to know their well being standing.

COVID search tendencies even confirmed who we (effectively, who Google) put belief in. The search engine outcomes web page (SERP) for the key phrase “coronavirus” gave weight to native authorities over nationwide ones. It most popular knowledge from a privately held firm, somewhat than the world famend John Hopkins University.

Semrush analyzed search, key phrase, and natural site visitors knowledge over an 18 month interval (March 2020 – August 2021) to see how on-line consumer conduct developed via the lens of COVID. Let’s begin with a brand new strategy to converse.

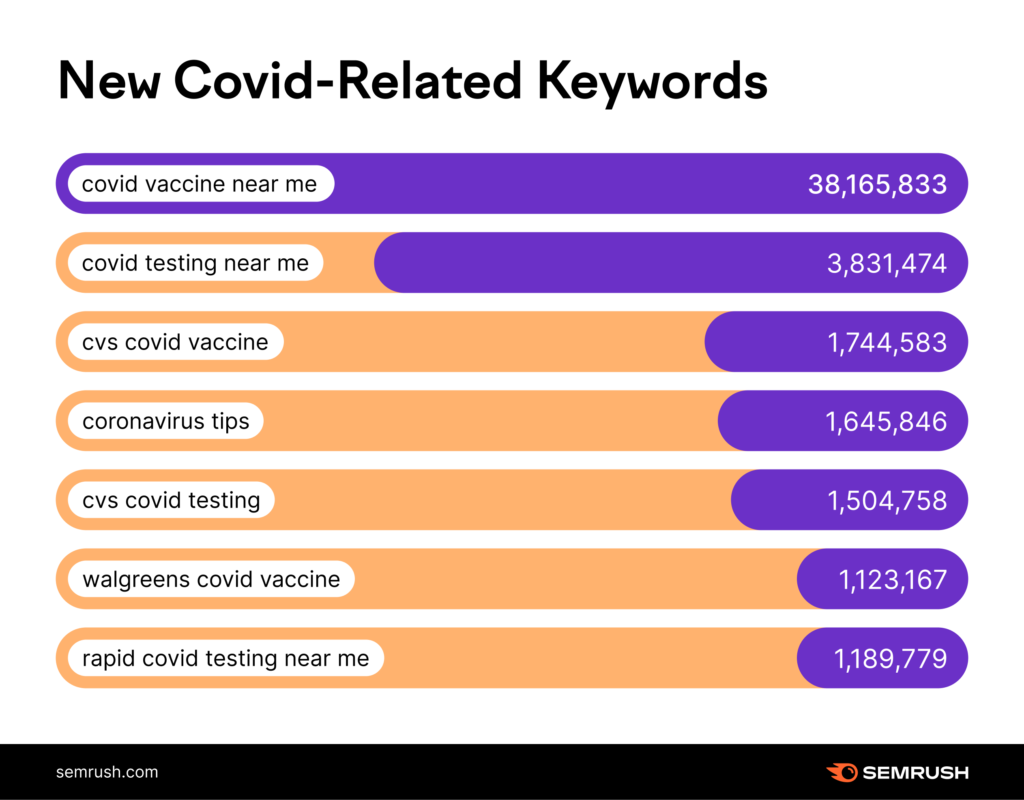

In the US alone, individuals Googled “covid vaccine near me” over 38 million instances each single month. The following key phrases had a mean month-to-month search quantity of over 1 million from March 2020 – August 2021, in the US.

Some of those phrases weren’t related at the onset of the knowledge interval (March 2020), as there was no vaccine. That means the present common of a few of the key phrases is way greater than what you see right here!

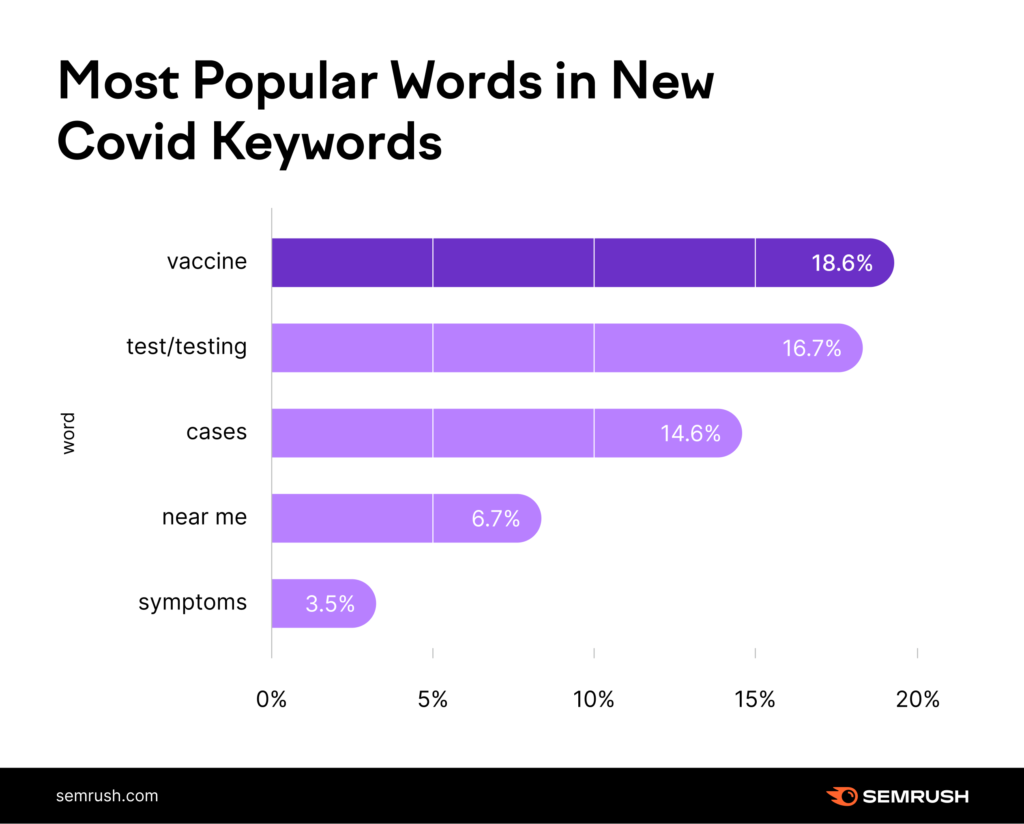

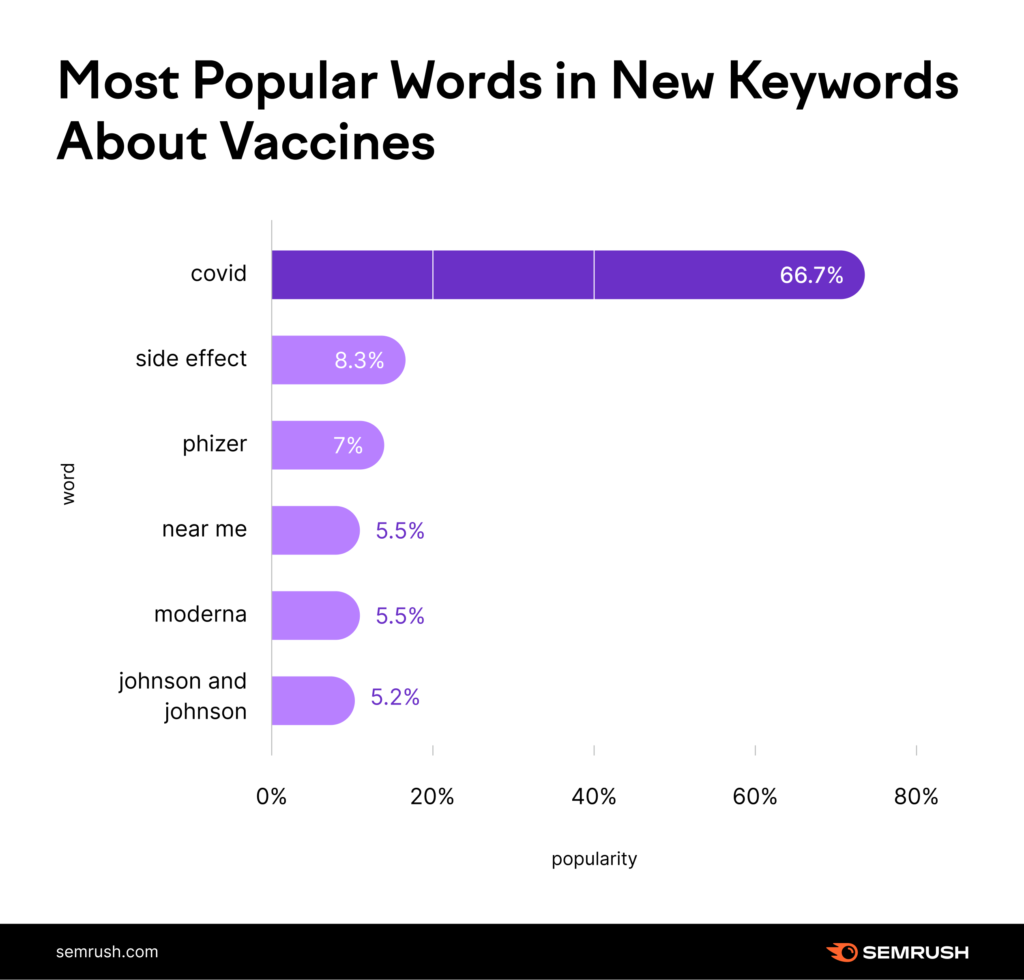

Of the 425 key phrases that displayed the most search quantity progress in the US since March 2020, here’s a breakdown of the hottest terminology discovered inside the key phrase set.

Keywords associated to vaccines grew to become extra common than key phrases associated to COVID testing. This knowledge highlights the craving for an answer to COVID (vaccines), over a mitigation (exams).

Keyword Changes Over Time

To seize evolving attitudes in direction of the pandemic, we tracked the enhance and reduce in search quantity for pandemic-related key phrases from June – August 2021. Particularly, to see how the vaccine roll-out impacted what individuals had been looking on Google.

Of the 47 COVID-related key phrases that decreased by 40% or extra in the designated timeframe, right here’s what they’d in frequent.

- 8 key phrases (like “covid relief bill” and related) relate to the COVID stimulus. As there was no indication of one other stimulus in the US, this development of decreased searches is sensible.

- 18 key phrases (like “covid 19 india” and “covid colorado”) instantly relate to or suggest a necessity to know the variety of instances in a location. As the pandemic has dragged on, regardless of surges, individuals had been much less fascinated with the “numbers.”

- 9 key phrases (like “nose burning coronavirus” and “is coronavirus testing free”) relate to testing or signs associated to COVID. This lower could suggest that individuals already knew the routine when it got here to testing or figuring out indicators of COVID an infection.

Vaccine Keywords

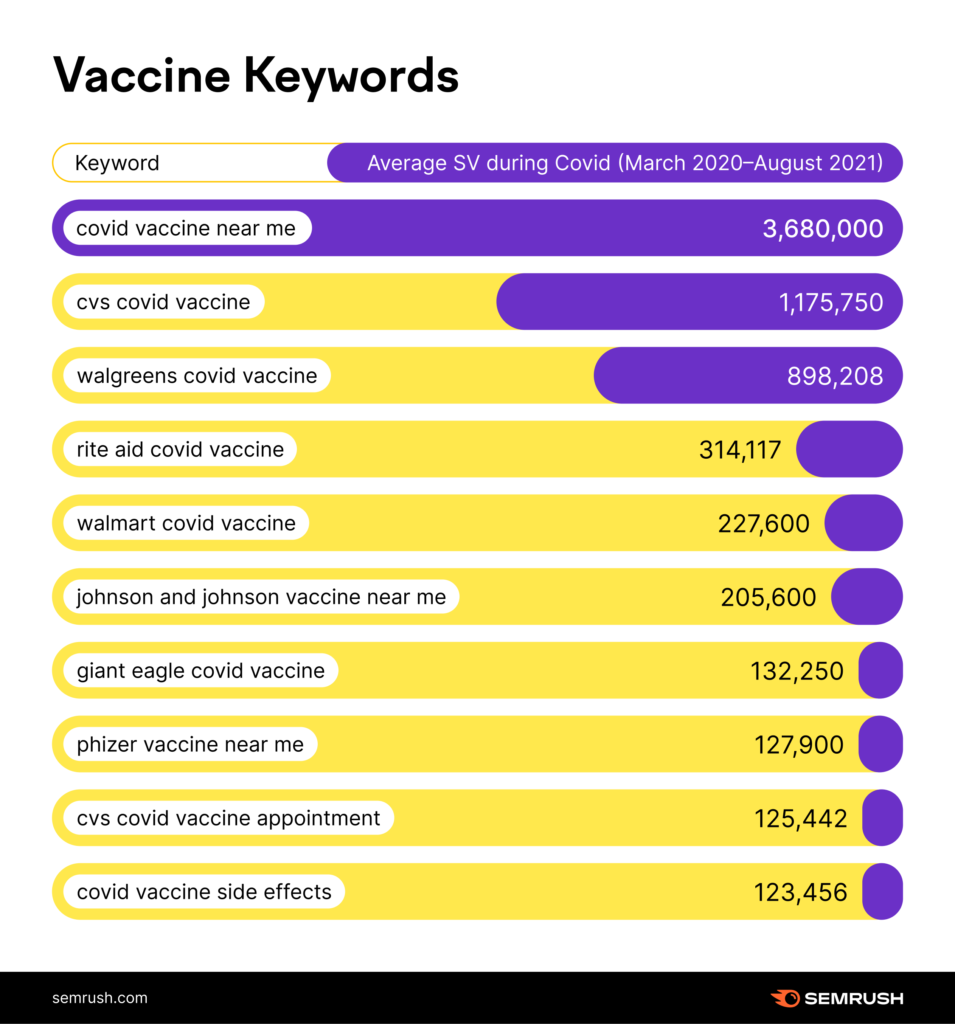

We additionally checked out 325 of the hottest key phrases associated to COVID vaccines. Here the common search quantity was 44,994 searches monthly.

Of the prime 10 vaccine-related key phrases, 9 of them are about vaccine availability regionally, with each the names of the vaccine and/or institution talked about in the question itself.

The tenth hottest vaccine-related key phrase, “covid vaccine side effects,” speaks to the need to learn about selections associated to private well being, with 125K month-to-month common Google searches.

In truth, key phrases that relate to the unwanted side effects of the vaccine had been evident in over 8% of the hottest vaccine-related key phrases, additional indicating a need to learn. “Side effect” key phrases had been much more common than vaccine producers, resembling “Pfizer” or “Moderna.”

The Coronavirus SERP

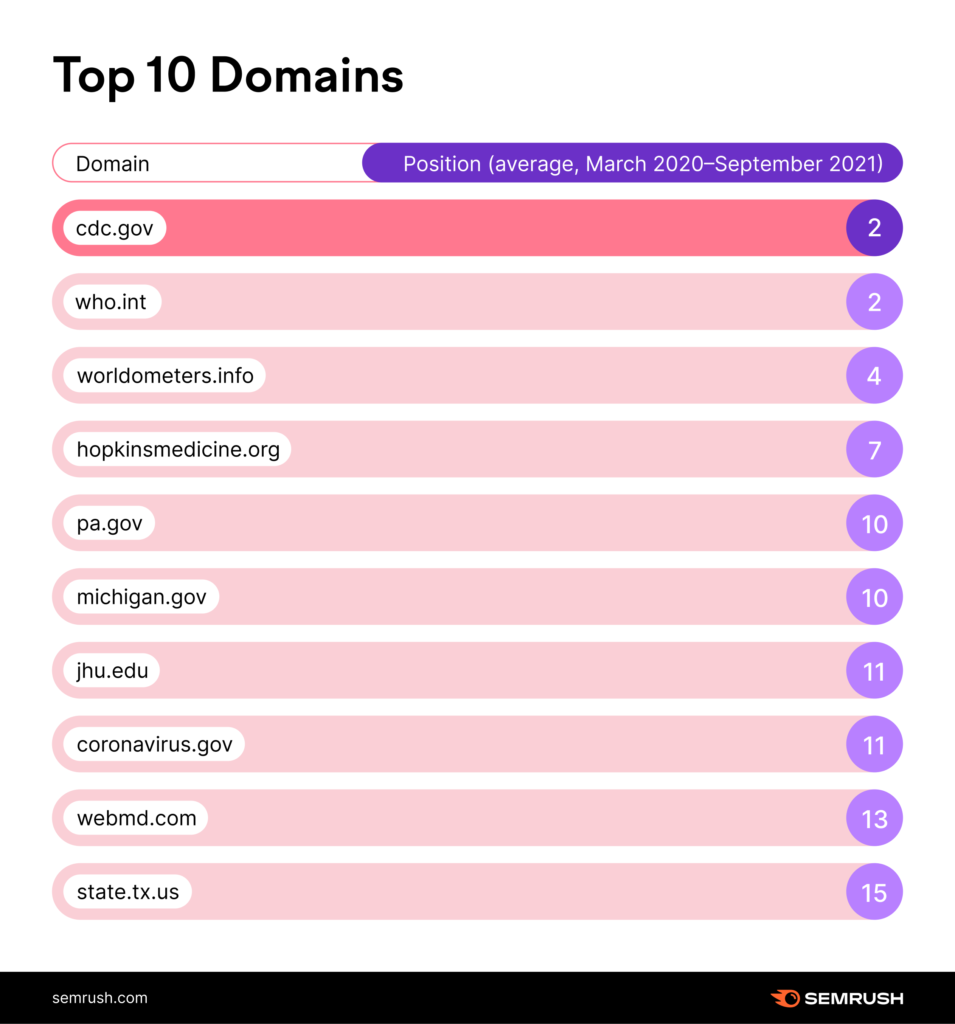

To get a snapshot of the most outstanding pandemic authorities (in the eyes of Google), we tracked the most extremely ranked websites for the key phrase “coronavirus” from March 2020 – September 2021.

Here are the prime 10 domains:

Unsurprisingly, the CDC and the WHO are the prime two rating URLs on common.

When taking a look at solely the top-ranking URLs, of the prime 20 domains, 14 are government-run web sites. Out of these 14 websites, an astounding 9 of them are native authorities websites, not nationwide websites. Of these 9, one is a hyper-local area—lacountry.gov (in the event you embrace dc.gov you possibly can argue that 2 out of 9 are hyper-local domains).

Google opted for much less nationwide protection, and extra native protection, on the SERP for this very important key phrase, “coronavirus”. This raises the query—why was one state authorities ranked and one other not? For instance, New York, one among the hardest-hit states, was not amongst the prime 20 domains.

State-run websites additionally tended to rank higher than different nationwide well being websites resembling the NIH and even the FDA.

Also noteworthy is the extent to which Google positioned belief in the privately run worldometers.information, owned by Dadax, LLC. Worldometers.information was most popular by Google over knowledge collected by Johns Hopkins University—the solely .edu on this record.

When taking a look at the top-ranking domains and contemplating all of the URLs from these domains that rank amongst the prime 50 outcomes, the outcomes open up a bit.

For instance, right here the CDC’s coronavirus.gov was the eighth best-ranked website general, not the sixteenth. Also, the ArcGIS knowledge dashboard, powered by Johns Hopkins, ranks amongst the prime 20, together with Wikipedia and the extra acquainted Washington Post.

Still, native authorities websites dominated with a exhibiting of seven domains.

Lastly, the IRS appeared on the prime 20 record. This was seemingly an indicator of how vital the monetary aspect of the pandemic was to Google, as the IRS website was the epicenter of assorted stimulus checks.

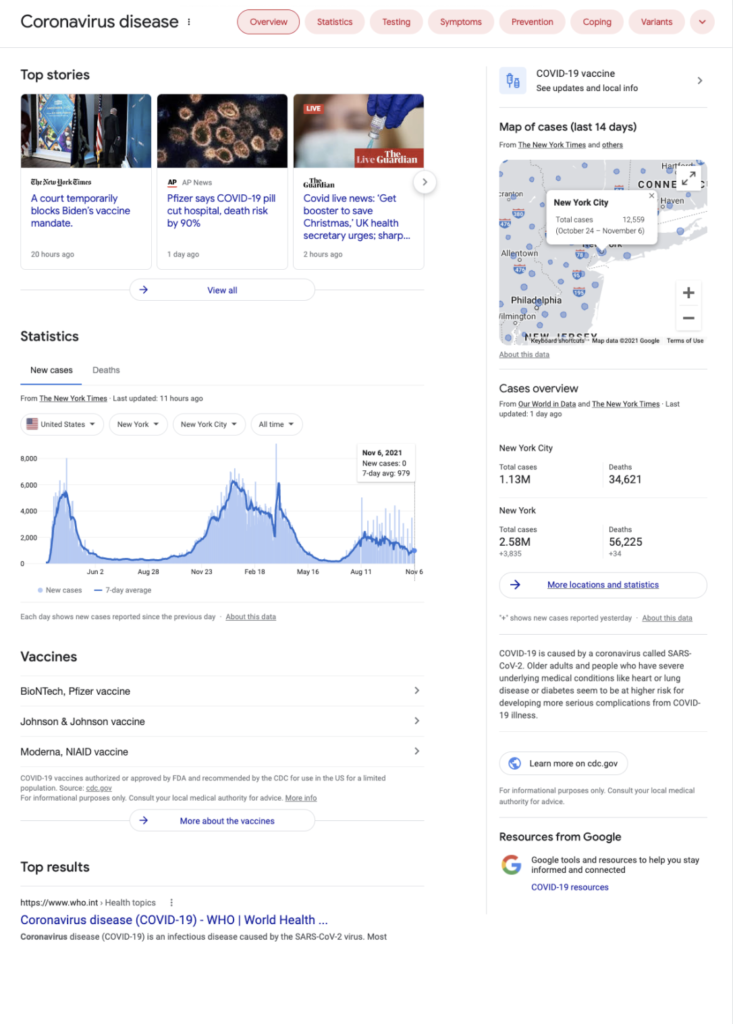

It’s prudent to keep in mind that the prime of the SERP, the above the fold part, was dominated by Google’s personal properties, powered by varied knowledge sources:

Industry Snapshot: Restaurants

One of the greatest modifications to life throughout the pandemic was the capacity to frequent eateries. As lockdowns grew to become a part of regular life there was an apparent shift to takeout and supply choices.

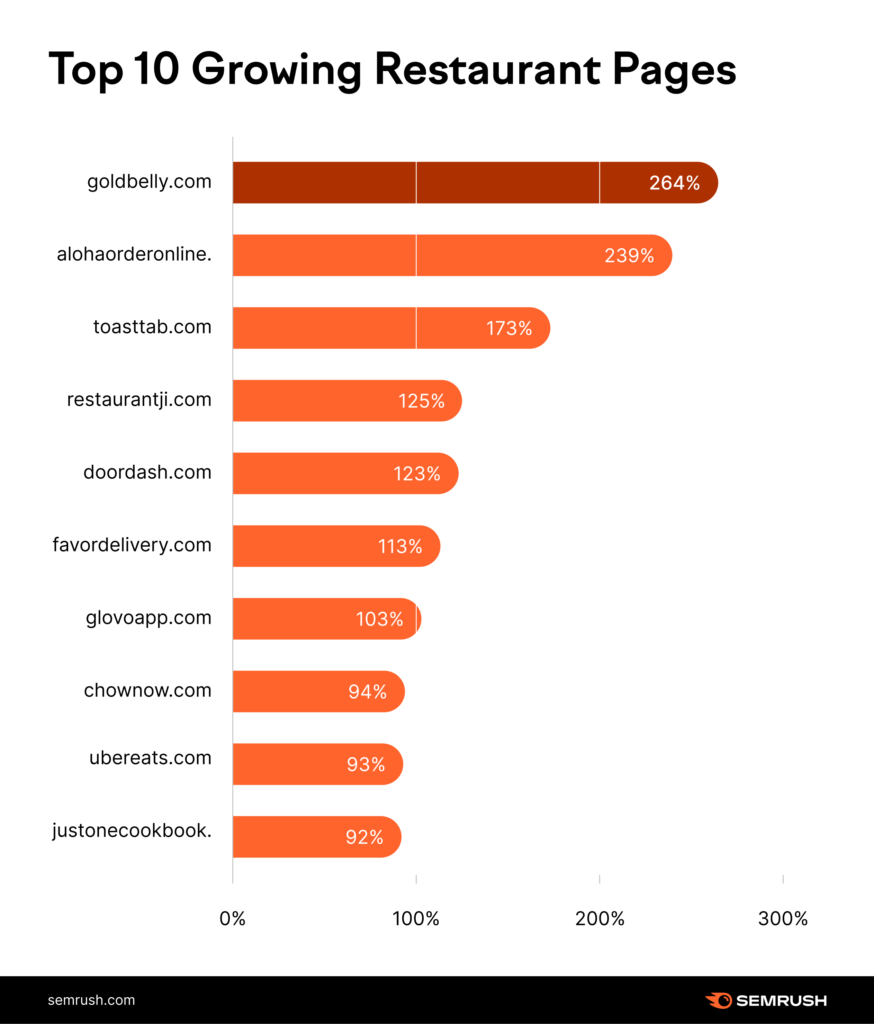

To higher qualify this shift, we analyzed the prime rising restaurant-related web sites as measured by their progress throughout the first 5 months of the pandemic relative to their natural presence throughout the 5 months main as much as the pandemic.

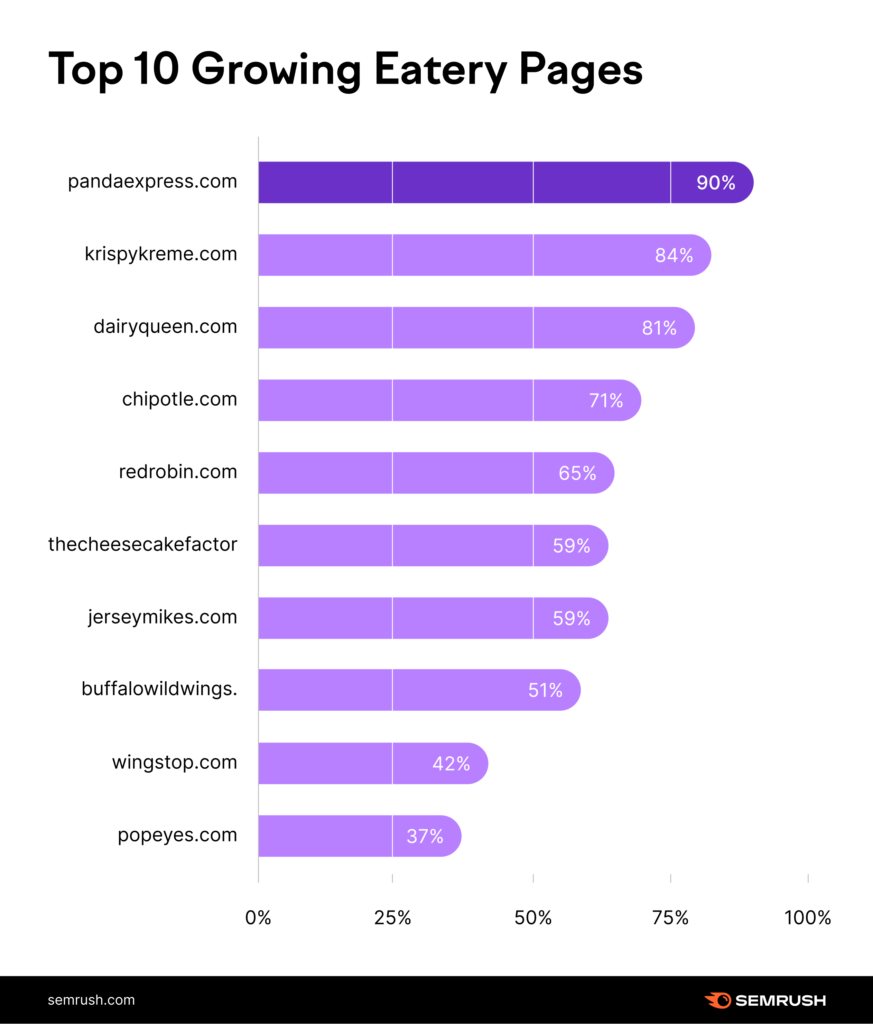

Overall, there was a 26.65% enhance in natural site visitors inside the vertical. Here are the prime 10 rising websites inside the restaurant key phrase class, all associated to meals supply.

5 of the 10 eatery-related websites with the most natural progress at the onset of the pandemic are associated to on-line meals supply. DoorDash topped the record of such websites with 122.65% natural progress!

However, the prime rising website, with 264.26% natural progress was Gold Belly, a website the place native eateries are featured for delivery throughout the US. This may level to the significance of supporting native and smaller institutions throughout the peak of the pandemic.

The 2nd and third listed websites, “alohaorderonline”and “toasttab” are each associated to software program options to assist native eating places thrive on-line.

The precise eateries that confirmed the most natural site visitors progress at the onset of the pandemic embrace:

Absent from the record are a few of the largest chains resembling McDonald’s, Wendy’s, Taco Bell, and many others. Perhaps as a result of these fast-food institutions are usually not identified for his or her supply providers. Dominos, nonetheless, clearly identified for supply, can also be absent from this record.

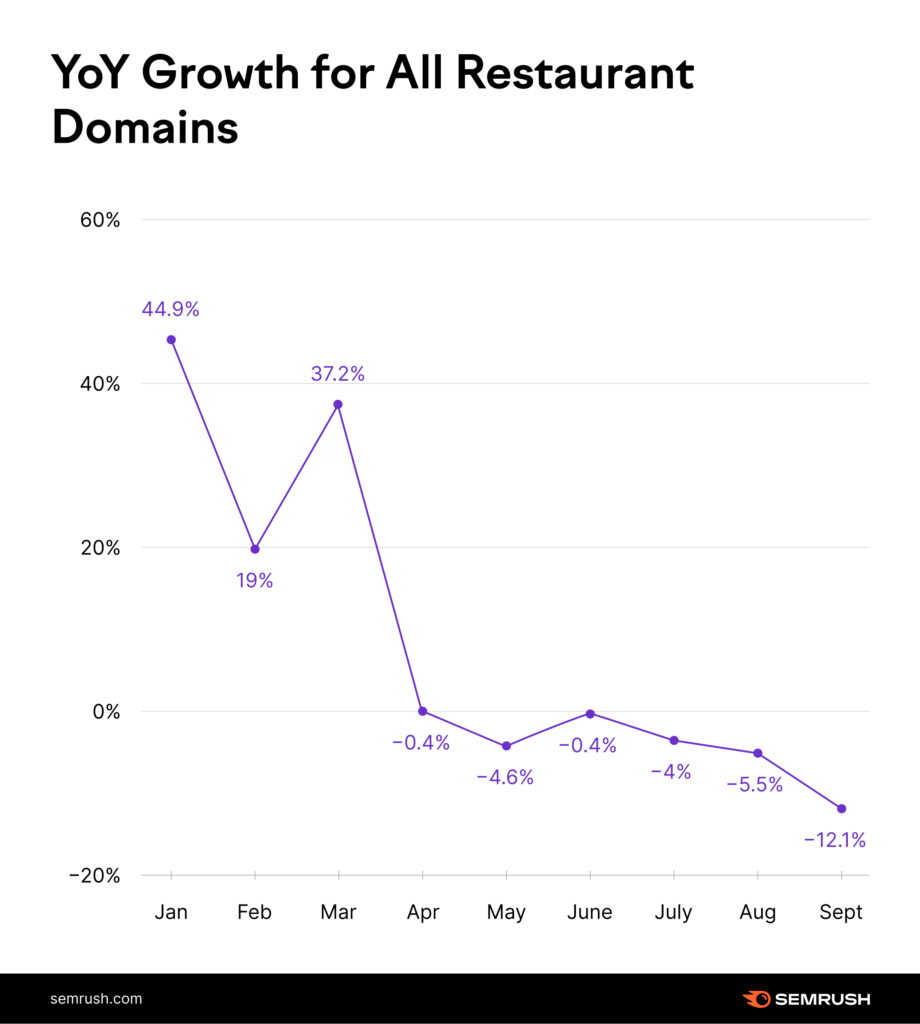

As the world opens, these progress numbers stagger. Heading into the spring of 2021, and summer season of 2021, the websites analyzed right here had been not on a progress trajectory. They started a reclining development in direction of normalized ranges.

Industry Snapshot: Travel

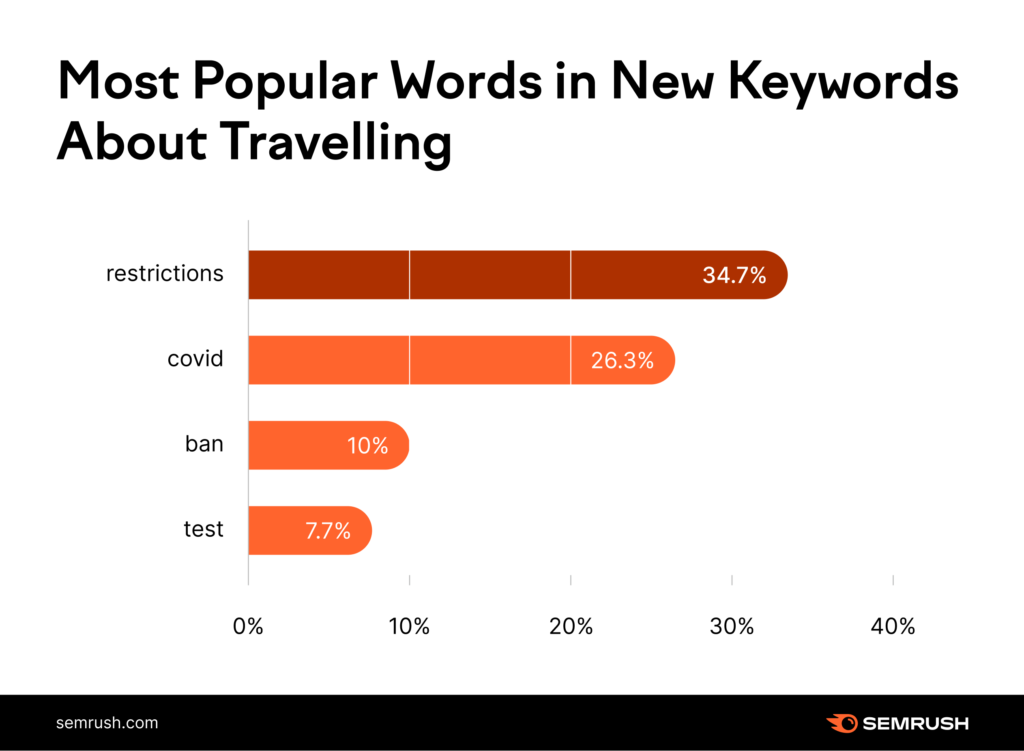

The journey trade was despatched into a tail-spin as international locations, cities, and airways shut down. We analyzed key phrases that had little to no searches (search quantity) however confirmed the most progress throughout the pandemic. The concept is to indicate how the journey trade and other people modified because of the pandemic.

Looking at key phrases with the highest common month-to-month search volumes (March 2020 – August 2021), there’s a predominance in direction of discussing journey bans and restrictions. Keywords resembling “travel hawaii gov,” “pennsylvania travel restrictions,” and “eu travel restrictions” went from nothing to tens of hundreds of searches monthly.

In truth, the common progress in search quantity of the 300 journey/COVID key phrases we analyzed is simply above 22,000%!

Of these 300 key phrases, the following phrases had been the most frequent. This highlights how consumer conduct modified in the case of journey queries and what info is the most related.

However, this development is fading quick. As the world reopens, astounding search quantity averages for these key phrases have decreased.

Looking at the similar key phrase set from June – August 2021 (as inoculations rolled out and the US reopened an increasing number of), the similar dataset solely grew 65%. Meaning, search quantity progress for key phrases associated to bans, restrictions, and COVID was down over 99%!

The knowledge demonstrates a shift away from a “restrictions” perspective of journey. Good information for the journey trade! People are returning to their “normal” mindset round journey.

Organic Traffic on the Web

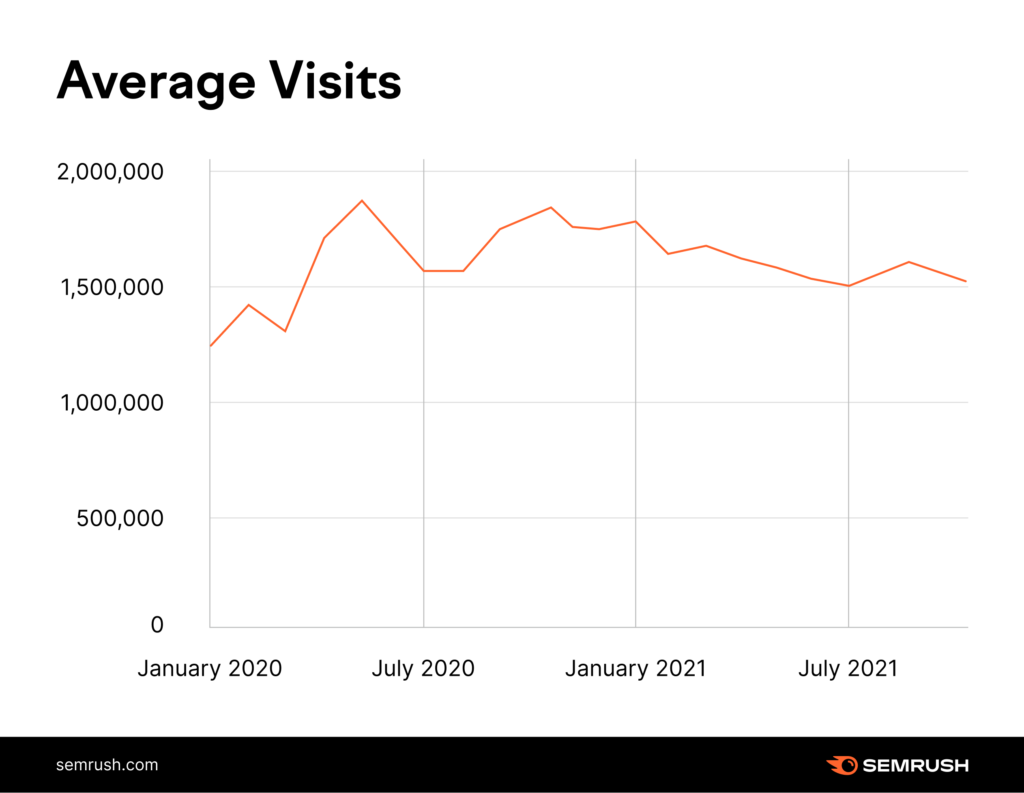

In 2020, the prime 100K websites inside our dataset acquired a mean of 1,559,337 visits monthly. In 2021, that quantity jumped to 1,603,418—a 2.83% enhance. However, a lot of the enhance is because of ranges earlier than the pandemic.

January 2020 – March 2020 the common quantity of web site site visitors was 1,308,556, with a month-to-month excessive of 1,405,230 (February 2020). April 2020 noticed a mean of 1,693,276. Meaning, the pandemic resulted in a 29% enhance in site visitors.

After January 2021, site visitors ranges got here again down. This is probably the finish of peak COVID site visitors and a return to a normalized SERP. What that stage of normalization is, stays to be seen.

Ecommerce

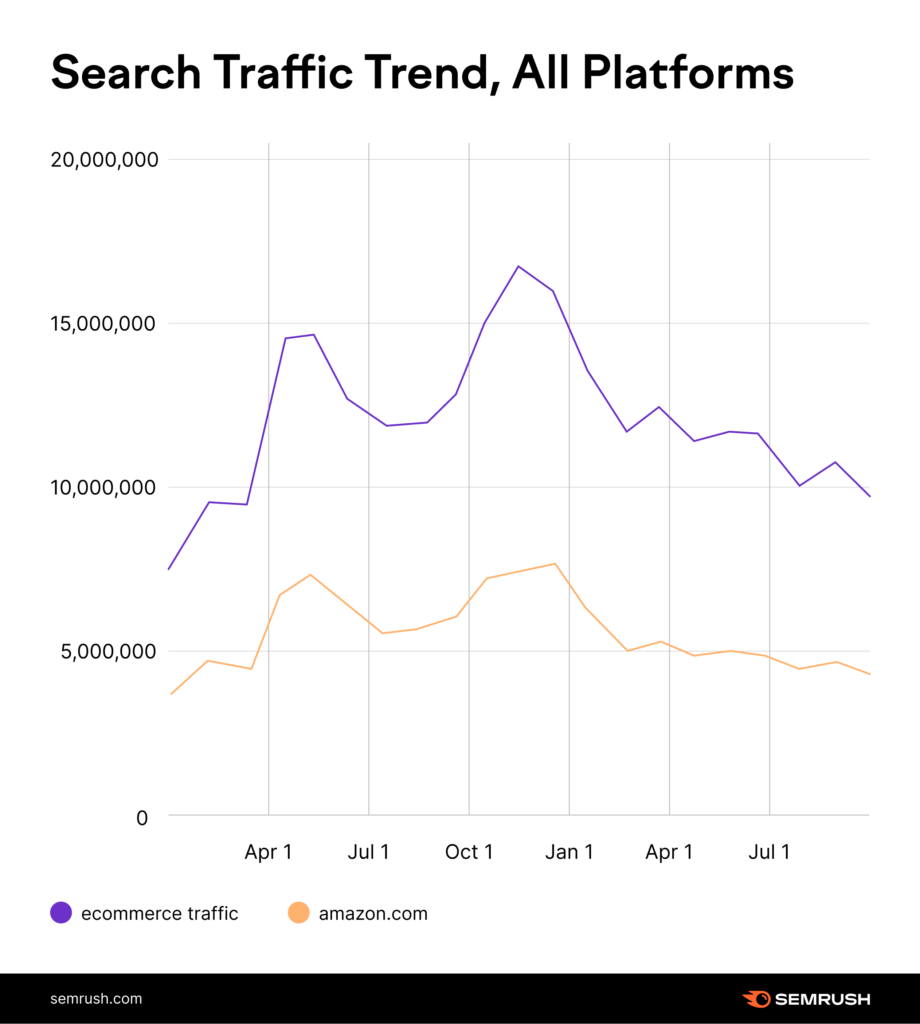

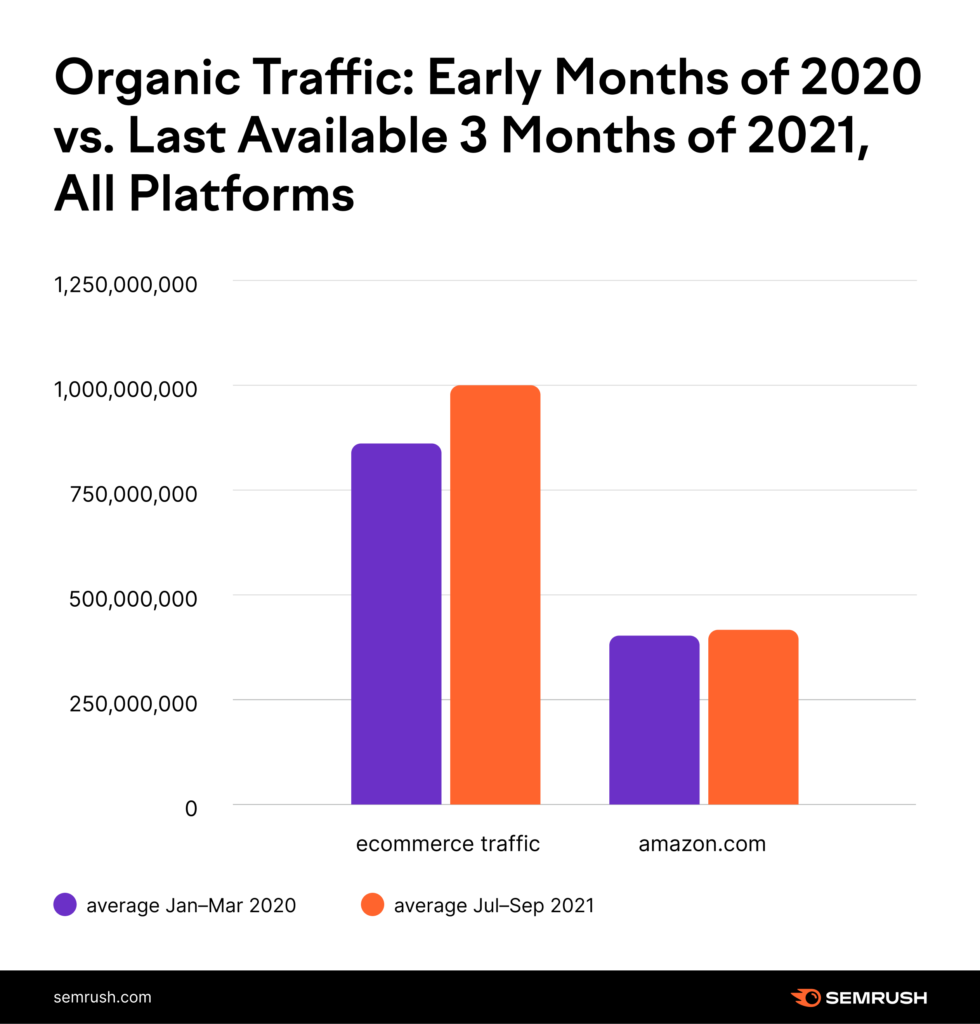

The site visitors development helps what’s being seen in the ecommerce area particularly. Overall, ecommerce noticed a major shrinking of its collective natural site visitors. Year-over-year, general natural site visitors for ecommerce websites decreased 23.24%.

Amazon noticed an much more important downturn with a 37.5% lack of natural site visitors in comparison with 2020. This represents Amazon shedding 18.58% of its natural site visitors market share.

However, we aren’t at pre-pandemic ranges on this area both.

In truth, the first 3 months of 2020 introduced 15% much less natural site visitors to ecommerce websites than what was recorded between July – September 2021.

While the world’s ecommerce conduct is returning to pre-COVID ranges, we’re not there but. But, will we ever be?

It’s nonetheless unclear if natural site visitors inside the ecommerce sphere will ultimately return to pre-COVID ranges or if the pandemic left us with a brand new regular (15% extra natural site visitors to ecommerce websites relative to pre-pandemic ranges). If the latter, a stabilization level of natural ecommerce site visitors stays unknown.

Overall Takeaway

Release of the COVID-19 vaccine put the world on a brand new trajectory. It additionally reset the natural advertising panorama. Organic site visitors was up general in 2021, however noticed a downturn that started with the gradual world reopening. As in-person experiences grew to become safer, individuals spent much less time in entrance of laptop screens and extra trip in the world.

Understanding this new context for natural site visitors is important to forecasting natural progress and analyzing efficiency over the previous 12 months. It additionally means loads is left unresolved. While it’s extremely unlikely the natural panorama will return to pre-COVID ranges, we nonetheless don’t know what’s going to occur.

The stunning shift in ecommerce websites and Amazon’s weakened grip on the SERP could level in direction of a brand new on-line procuring panorama. Curb-side pickup demand might drop off the face of the earth, or it might simply be getting began. Smaller ecommerce gamers may win SERP floor, or the massive boss Google Shopping might sweep all of it away.

Keep cautious observe of modifications in patterns however don’t rush to conclusions. It’s vital to fastidiously observe what’s taking place to your website and what’s taking place inside the ecosystem itself. The sands are nonetheless shifting and nobody is aware of the way it will all in the end play out. Monitoring the state of affairs fastidiously is the neatest thing you are able to do for the success of your website or your consumer’s website.

To study extra, obtain the full Semrush State of Search 2022 ebook. It’s full of relevant perception into key phrase tendencies, consumer conduct, and trade benchmarks. If you’re able to stage up your search advertising sport, that is the e-book you want.